What is Bank account reconciliation?

Bank reconciliation involves comparing your bank statement with your personal records to ensure they align. Its purpose is to identify and resolve any discrepancies between the two sets of records. The aim is to maintain accurate and up-to-date financial records, which are essential for efficient financial management. (Bank reconciliation in business central)

A frequently asked question is: What does it mean to reconcile your bank statement?

Bank reconciliation is the process of comparing your bank statement with your personal records to ensure they are consistent. Its primary purpose is to detect and resolve any discrepancies between the two sets of records. The ultimate goal is to keep your financial records accurate and current, which is vital for effective financial management.

Bank account reconciliation in Business Central

Bank reconciliations should be performed regularly for all bank accounts to ensure the accuracy of the company’s bank and cash records. This involves comparing and matching entries from your ERP bank accounts with transactions on your bank statement. Once reconciled, the balances are posted to your ERP bank accounts, making the totals accessible to finance managers. Bank reconciliation also helps identify and resolve missing payments or bookkeeping errors.

The task can be completed on the Bank Account reconciliation page, where you reconcile bank statement lines on the left side with your internal bank account ledger entries on the right.

Create Bank Account Card

Path:

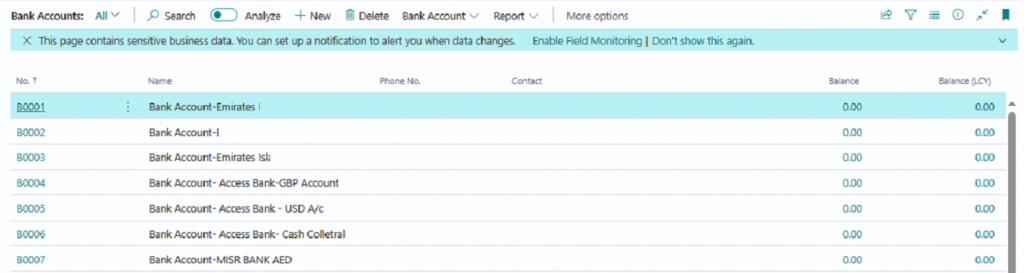

→ Choose icon or else press alt+Q, enter Bank Account, and then choose the related link.

→ It will Open List page

→ Click on New button

→ It will open new Bank Account Card

→ Enter relevant Information:

General Fast Tab:

No. No will manual. Enter manual no. according to bank. Check previous Bank Accounts for reference.

Name: Enter name of the Bank.

Bank Branch No: Mention Branch No of the Bank.

Bank Account No.: Bank Account Number. The same will be printed on Invoices.

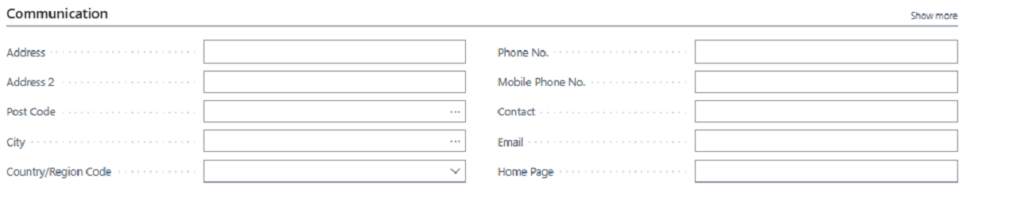

Communication Fast Tab:

Enter relevant Information in Communication Fast Tab:

Address: Enter address details.

Address 2: Enter address details.

Post Code: Enter postcode of the bank.

City: Enter city code of Bank.

Country/Region Code: Country code select from drop-down list.

Phone No.: Enter phone no.

Contact: Enter contact person of Bank.

Email: email address of bank for communication.

Home page: Home page of bank.

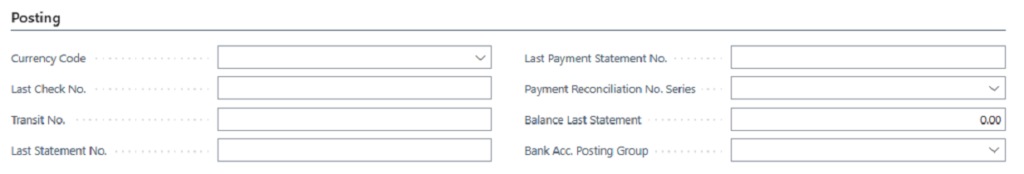

Posting Fast Tab:

Currency Code: Enter currency code of the Bank from Drop down list. For instance, Specifies the currency code that is inserted by default when you create purchase documents or journal lines for the vendor.

Bank Account Posting Group: Select bank account posting group from drop down list. Specifies a code for the bank account posting group for the bank account.

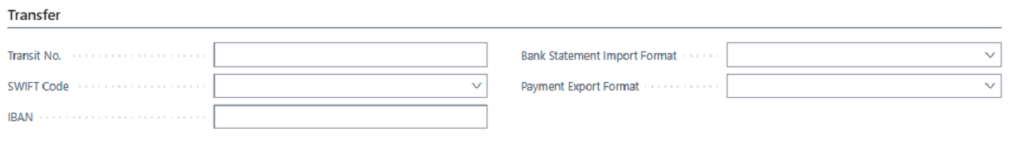

Transfer Fast Tab:

Swift Code: Enter swift code

IBAN: Enter IBAN code.

Press back button or esc to come back to Bank account list page. The new bank account has been created and will be visible in Bank account list page.

Bank Account Reconciliation Process in Business central

To reconcile bank accounts in Business Central, Business edition with statements received from the bank, you must fill in the lines in the Bank Acc. Reconciliation window.

Bank reconciliations are used to compare the open bank account ledger entries with the bank statement transactions. When you run the reconciliation batch, for each open bank account ledger entry, a reconciliation line is created. If all the suggested reconciliation lines match the bank statement lines for the corresponding date range, the reconciliation can be posted.

Path:

→Choose the icon or else press alt+Q, enter Bank Account reconciliation, and then choose the related link.

→It will Open List page.

Bank Account No.: Select Bank Account No from drop down list.

Statement No.: System will update the statement number

Statement Date: Enter Bank Statement date

Balance Last Statement: It will be updated Automatically

Statement Ending Balance: Enter statement ending balance.

To fill bank reconciliation lines with the Suggest Lines function, enter the starting date and the ending date. And then click on OK, the system will also fill the left side, the bank statement lines.

Match bank statement lines with bank account ledger entries manually

On the Bank Account Reconciliation page, select a non-applied line in the Bank Statement Lines pane.

In the Bank Account Ledger Entries pane, select one or more bank account ledger entries that can be matched with the selected bank statement line. To select multiple lines, press and hold the Ctrl key.

Choose the Match Manually action.

The selected bank statement line and the corresponding bank account ledger entries will change to green font, and the Applied checkbox in the right pane will be selected.

Repeat steps 1 through 3 for all unmatched bank statement lines.

To remove a match, select the bank statement line, and then choose the Remove Match action.

Match bank statement lines with bank account ledger entries automatically

On the Bank Account Reconciliation page, choose Match Automatically. The Match Bank Entries page will open.

In the Transaction Date Tolerance (Days) field, specify the number of days before and after the bank account ledger entry posting date within which the system should search for matching transaction dates in the bank statement.

If you enter 0 or leave the field blank, the Match Automatically function will only search for transactions with matching dates on the bank account ledger entry posting date.

Choose the OK button.

All bank statement lines and bank account ledger entries that can be matched will turn green, and the Applied checkbox will be selected.

To remove a match, select the relevant bank statement line and choose the Remove Match action.

Finally, click Posting → Post to post the bank account reconciliation lines.

Wow! Ich genieße wirklich das Template/Thema dieser Website.

Es ist einfach, aber effektiv. Oft ist es sehr schwierig, das “perfekte Gleichgewicht” zwischen Benutzerfreundlichkeit und Aussehen zu bekommen. Ich muss sagen, dass Sie einen ausgezeichneten Job damit gemacht haben.

Außerdem lädt der Blog super schnell für mich auf Firefox.

Außergewöhnlicher Blog!